"ki-ki-ki-kia" (nforsythe)

"ki-ki-ki-kia" (nforsythe)

02/20/2014 at 09:56 • Filed to: None

1

1

5

5

"ki-ki-ki-kia" (nforsythe)

"ki-ki-ki-kia" (nforsythe)

02/20/2014 at 09:56 • Filed to: None |  1 1

|  5 5 |

So I am completely confused with how importing cars works.

I looked online and all I can find is that there is a 2.5% tax on cars.

So lets say I am interested in importing this

http://www.goo-net-exchange.com/usedcars/SUBAR…

Without shipping whats the deal? How difficult would it be to import this?

Thanks OPPO!

Dsscats

> ki-ki-ki-kia

Dsscats

> ki-ki-ki-kia

02/20/2014 at 09:59 |

|

Why would you import a car already sold in the us? And if it's under 25 years, you need to certify everything and that's probably at least $10,000. Unless it's more than 25 years old, STAY AWAY.

505Turbeaux

> ki-ki-ki-kia

505Turbeaux

> ki-ki-ki-kia

02/20/2014 at 10:02 |

|

http://www.nhtsa.gov/cars/rules/imp… go here and read. It would be at least 10 large to certify that thing, after you get it here. Has to be done by a shop that is nhtsa certified

ki-ki-ki-kia

> Dsscats

ki-ki-ki-kia

> Dsscats

02/20/2014 at 10:03 |

|

Thanks for the info. I just used this as an example

Thunder

> ki-ki-ki-kia

Thunder

> ki-ki-ki-kia

02/20/2014 at 13:44 |

|

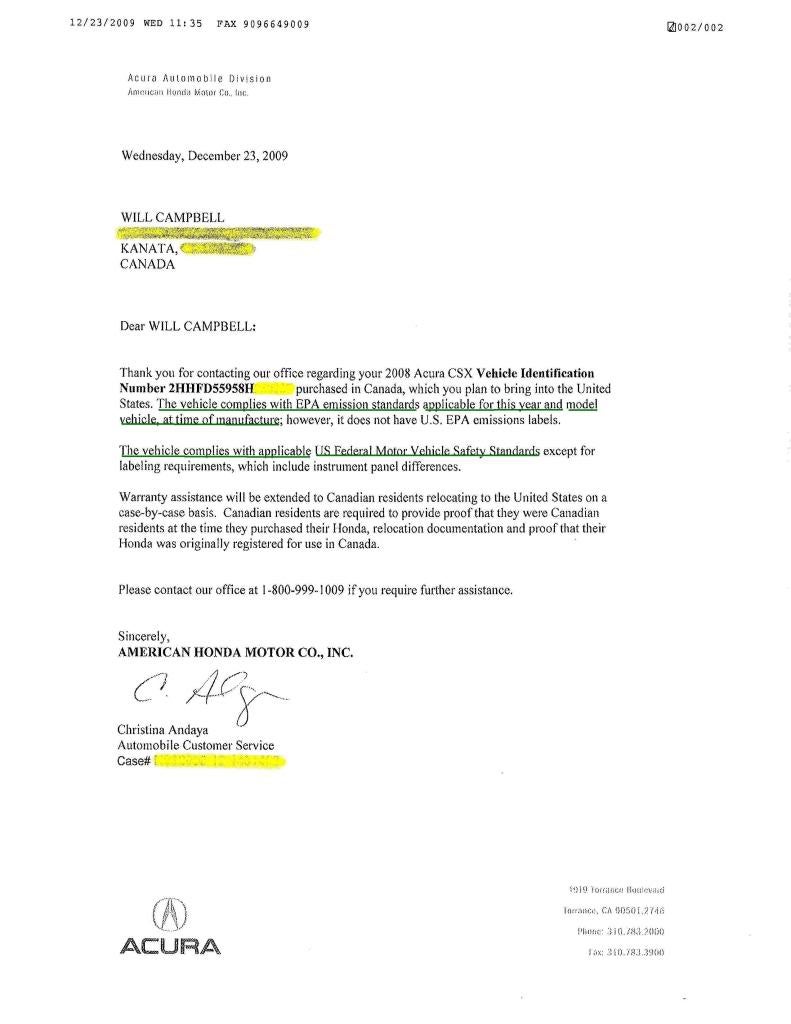

How about an Acura CSX-S? Effectively it's an 8th generation Honda Civic Si sedan (which is something I used to own and miss dearly) with uplevel interior and some options that weren't on the Si.

I'd get myself another Si, but I'd rather have one with all the extras.

I've seen online here an example that shows the letter of compliance:

So... can that be done? Does that only apply to a Canadian moving to the US, or can it apply to a US citizen purchasing in Canada? Would I need a letter like that specific to a given VIN?

ki-ki-ki-kia

> Thunder

ki-ki-ki-kia

> Thunder

02/20/2014 at 14:56 |

|

Good question. I believe someone has mentioned this somewhere before but I can't remember what the response was. Maybe an Oppo question for a later time?